SERVICES

Forensic

Audits and Securitization Audits

If you have missed 2 or more payments on your

mortgage then you should consider getting a mortgage audit to help you

persuade your lender to give you a new loan program.

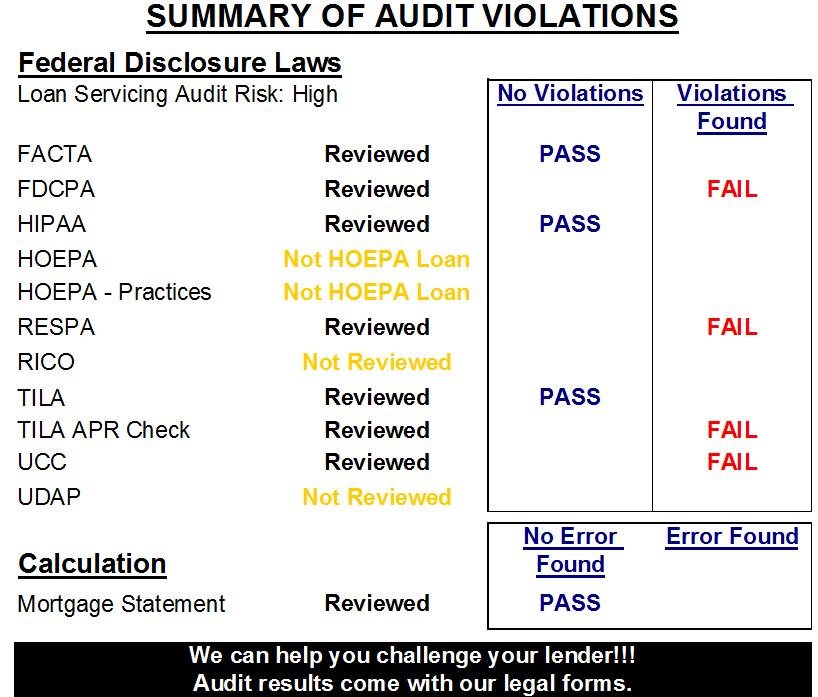

What

is a forensic audit? AUDIT OF THE BORROWER's

EXPERIENCE

The audit

is a review of the mortgage related documents signed by the borrower on

the day of closing. The audit focuses on disclosure

violations of federal law (TILA, RESPA, FDCPA, HOEPA, UCC, and others)

and state laws (common law, fees, yield spreads, contract law, and

others). The audit also looks for commissions violations,

refund eligibility, misapplied payments, calculation errors,

application fraud, and more.

What

is a securitization audit? AUDIT

OF THE NOTE AND MORTGAGE DEED's EXPERIENCE

The audit is a review of

the sale transaction that took place after you received your

loan. The audit focuses on chain of title, note and deed

possession issues, and more.

Successful audits can enable you to obtain rates below 3%, term

extension as long as 45 years, and (if applicable) STOP

Foreclosure. You could also be entitled to a cash refund or be

able to cancel your mortgage all

together and get your DEED FREE AND CLEAR!

Commercial

and Wholesale Mortgage Audits

If you have a business or are interested in

starting your own audit business, you can obtain commercial and

wholesale audits from MortgageAudit.com.

A Commercial

Loan Audit & Analysis involves

a very comprehensive analysis of a business and its related

property(ies) that are subject to commercial loans. The primary purpose

of the audit/analysis is to obtain improved terms on an existing note,

and improve the cash flow of the business.

Wholesale

Loan Audits are Forensic and Securitization Audits that

are priced specifically for business clients. Each completed

audit comes with a complimentary Attorney Consultation. These audits

can and have been used sucessfully to:

- Stop foreclosure

- Obtain loan

modifications,

- Cancel loans, and

- Assist in winning

monetary damages for borrowers

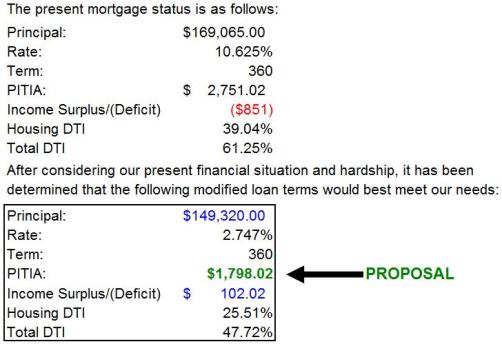

4 Step

Loan Modification Software FREE Download!!

This easy to use loan

modification software will prepare a professional loan modification

package for you that is fully ready to be submitted to your lender for

FAST approval!! It also takes into account

President Obama's Making Home Affordable Program guidelines, and let's

you know exactly what you need to do to have your request qualify for

the program!!

The

software comes with a step-by-step detailed instructional video that

walks you through the 4 easy steps (see the video on this website for a

sneak preview). Also, the video includes abonus feature on How

to GET PRINCIPAL REDUCTIONS AND on How to Cancel Mortgages!!

DIY Credit Repair Program Ebook and Software

If you are in need to rebuild your credit history

and equity, believe a creditor has wronged you, or your want to get out

of debt now this book will open your eyes to the hidden truth credit

card companies, credit reporting agencies, and credit repair companies

have been hiding from you.

You will understand how

to get back on your feet if you're in credit debt already. You will not

only learn how to get out of debt now, you will learn how to avoid

overspending, which is one of the possible reasons why you are in debt

now.

After reading this book

and using the CreditRepairACE Softwre Program, you will know more on

how easy it is to clean your credit report, establish good credit and

deal with creditors without the assistance of Credit Repair

Company.

Affiliate Program - Solutions Software Matrix

If you are interested earning income from our

services and products, join our free affiliate program today.

|

|

|